You’ve worked hard all your life and it’s now time to reap the rewards! When your retirement is just around the corner, how do you ensure that you retire right? What preparation is needed to make the most of your money before you reach this major milestone? If the time has arrived for you to start getting your ducks in a row, here are the top 10 questions to ask yourself before Retirement Day arrives.

1. Will I have enough money?

The amount of money you need in retirement will really depend on your own situation and the type of lifestyle you want to have. While your income will be lower in retirement, it’s important to remember that you will also pay less tax and you may have less outgoings too. For example, your mortgage and other debts will likely be paid off and your commuting bills will disappear.

On the other hand, you will certainly want to enjoy your newfound freedom, because now you’ll have the time! Opportunities to spend more on travel, developing new skills and indulging in hobbies, will likely unfold.

It’s very important to put a budget together and speak to your financial adviser, well in advance of retirement day. There are also some very useful online calculators that will work out what your net income will be after tax – such as this one from Deloitte, www.service.deloitte.ie. Give them a try, as you may be pleasantly surprised.

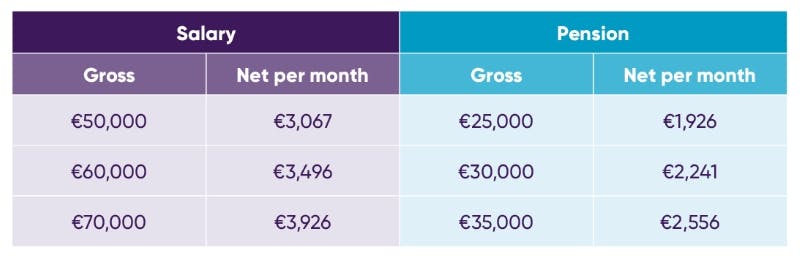

Here are some examples of net income after tax in retirement:

Examples based on: the 2021 tax year, a single PAYE individual, salary at 60 years old, pension at 65 years old. Gross pension assumed at 50% of Gross Salary.

2. Will I pay tax in retirement?

In short, yes. The rules around tax don’t change when you retire. However, in Ireland, the tax system is designed in such a way that the amount of tax you pay is proportionately lower for those on lower incomes; regardless of whether the source of that income is your employer or your pension.

For most people in retirement, their pension is significantly lower than what they were earning before they retired and, hence, the amount of tax is proportionately lower.

3. When will I get the State Pension?

If you have made enough PRSI contributions throughout your working life, you will be entitled to receive a Contributory State Pension - more commonly referred to as the ‘Old Age’ Pension. The current age to qualify for this is 66, although the government intends to increase this to 68 by 2028.

At present, most people can still retire at 65 i.e. before State Pension Age. If this is your situation, you can receive a payment between age 65 and 66 which is similar to Job Seekers’ Benefit. However, unlike Job Seekers’ Benefit, you don’t need to declare yourself to be available for work. The caveat here is that you must have stopped working in order to qualify for this benefit.

Another point to consider if you retire before State Pension Age is that you may be eligible to continue paying PRSI contributions, which could help you boost your PRSI record even though you are no longer working.

It’s always a good idea to request a copy of your total PRSI Contributions - colloquially referred to as ‘stamps’ - to see how many you have paid and how much you could qualify for. You can request this easily from www.services.mywelfare.ie.

4. Can I boost my pension before I retire?

There are very generous tax incentives to encourage people to fund for their retirement. Therefore, you may have the option to put a lump sum into your pension in the lead up to your retirement.

The main benefit to you here is Tax Relief, as you may be eligible to gain up to 40% tax relief on your contribution. When you draw this money out in retirement, the most common scenario is that you will get some of the amount you invested as a Tax-Free Lump Sum and then you pay Income Tax on the rest.

The amount that you benefit from this will depend on your Income Tax Rate before and after you retire. It’s also worth noting that there are limits on how much you can put into your pension each year.

The key thing here is, don’t leave it too late! This can only be done before you retire, so it’s important to speak to your financial adviser well in advance in order to really capitalise on this opportunity.

5. How much can I take out of my pension as a Tax-Free Lump Sum?

It’s very likely that you will receive a Tax-Free Lump Sum when you retire. The amount you are entitled to will depend on the type of pension you have. There are two main types:

- Occupational Pension

- Private Pension

For most people in an Occupational Pension Scheme, the maximum that you can receive tax-free is one and a half times your salary. In a Private Pension Scheme, the maximum is generally 25% of your overall pension fund. If you are in the fortunate position of having a large ‘pension pot’, the maximum amount that you can take out tax-free is capped at €200,000.

You may decide to use your Tax-Free Lump Sum, for example, to clear off your mortgage or any other debts. Oh, the satisfaction! Doing this will also help to reduce your overall outgoings in retirement.

6. What options will I have for the balance?

A lot of people ask, should I invest the balance of my pension in an Annuity or an Approved Retirement Fund (ARF)?

In simple terms, with an Annuity, you give the balance to an insurance company and then they pay you a fixed amount, every month, for the rest of your life. This is also referred to as a Guaranteed Income. However, with Annuity rates at historic lows at present, most people tend not to go for this option.

An Approved Retirement Fund (ARF), on the other hand, has much more flexibility and allows you to: 1) keep your funds invested and 2) decide how much income you want to withdraw each year. It is not a guaranteed income like an Annuity. However, it gives you much more control over how your pension pot is managed and, importantly, you can pass on any remaining funds to your loved ones when you die.

To invest in an ARF you need to have a Guaranteed Income for Life of €12,700, which the State Pension may provide you with. You also need to actively manage your investment with the help of your financial adviser, to ensure that your ARF can provide you with the income you need and want throughout your retirement.

7. If I have more than one pension, should I spring-clean them all?

A ‘Job for Life’ was once a very commonly used expression, but it’s not one that we tend to hear anymore. Nowadays, changing your employment happens much more frequently than it did for previous generations.

It’s unlikely that you will have only one employer throughout your working life. In fact, on average, people have eleven different jobs during their careers, therefore you could have just as many pensions!

Keeping track of them all can be challenging. It means that there is an increased possibility of having pensions left with your previous employer. So, it’s extremely important to bear this in mind and ‘keep tabs’ on your paid up or preserved pensions if you have moved jobs during your career.

It’s worth putting the effort into checking and following up on paid up pensions. If you don’t know where to start, it’s a good idea to talk to your financial adviser. At the very least, they can ask all the relevant questions on your behalf and equip you with the information you need to prepare for your retirement. Time well spent now will pay off in the future.

8. How will Inflation affect me in retirement?

Inflation is a measure of the rate of rising prices of goods and services. The cost of housing, groceries, energy, electricity, gas, insurance and more all increase over time because of inflation and those cost increases start to eat into what you're able to buy with your savings.

It’s worth considering that, if your savings are in a deposit account getting a 0% return and the Consumer Price Index is running at 3%, then you are essentially losing 3% every year on the value of your savings! Perhaps you can live with this over the short term, but you will hopefully be retired for 20-30 years or more and over the long-term inflation can have a devastating effect. But you have options, so talk to your financial adviser about this!

9. Where should I invest my money?

When it comes to investing, there are lots of options such as deposit, property, stocks, shares, or investment products; and the list goes on. Before deciding where to invest your money, there are several important questions you should ask yourself, including:

- What level of risk am I happy with?

- Do I need to have access to my investment?

- What returns am I looking for?

- Is my money guaranteed?

- Should I spread my investment around or is one institution good enough to manage all my money?

A rule of thumb with investments is that the money you need in 5 years’ time should be ‘working harder’ than the money you need next year. A retirement expert can guide you on how to achieve this. The important thing is to put together a solid retirement plan that best suits your individual needs.

10. What timeframe should I plan for in retirement?

Oh, to have a crystal ball! It’s perhaps best to not know the exact answer to this question, but what will certainly help is to know you have a plan in place.

The great news is that life expectancy for people in developed countries has increased significantly, by 20 to 30 years, during the last century. A by-product of this welcome, longer lifespan is increased financial risk, however, as you need to pay living expenses for all those extra years.

Another consequence of living longer is that people generally need more medical and long-term care as they age, so your annual expenses may increase later in life. For this reason, regular saving in retirement is advised. Hopefully the mortgage will be cleared, and the college fees gone, but you should continue your good saving habits long into retirement… and remember that inflation needs to be tackled!

It goes without saying that your physical wellbeing is of peak importance too, so working with your doctor to make the right choices for a healthy lifestyle is a must - like eating well and enjoying healthy hobbies. They’re key to your longevity.