Additional Voluntary Contributions or AVCs. You’ve heard of them, your colleague has one, but have you asked yourself – is an AVC for me? We’re here to show you that an AVC might be the investment you really need!

So why do I need an AVC?

There’s a lot of confusion about money and the Public Sector. You’ve probably heard your Private Sector friends say ‘sure you’re sorted for life!’ What’s often missed is, even if you work the full 40 years, your pension will be half of your salary - at most. With early retirement and career breaks, the reality is that you often end up with a lot less than what you need.

Like most of us, you could fall into one or more of the following scenarios:

1. You need to have extra money to enjoy your free life in retirement

2. You want to stop working as soon as possible and retire early

3. Your career means you have to retire before the state pension age of 66-68*

4. You started your career late

5. You can’t survive financially on half of your salary

If you do fall into one or more of these scenarios, investing in an AVC could be a great fix!

Can I afford it?

You can start your AVC from as little as €1 a day!**

On top of that, an AVC is designed to work through life’s ups and downs. You can stop your AVC if you’re saving for your new home, or increase your contribution amount when you are due an increment. Increase, decrease, stop and restart whenever you need to!

So why invest in an AVC and not just save?

Bank accounts and savings accounts aren’t always the best option if you need to save for your future. This is because deposit interest is at an all-time low of 0% and inflation can eat away at your money.

The Tax Saver incentives with AVCs are unreal!

- For every €50 you invest into your AVC you will receive €20 in tax relief – this means it only costs you €30!**

- Your AVC fund growth is tax free – other saving methods can be taxed and can chip away at the money you make

- With an AVC, you can maximise the tax free lump sum amount available to you at retirement***

What do people really get out of their Investment?

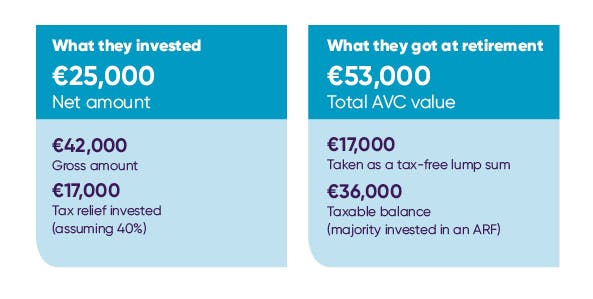

In 2018, over 1,500 Cornmarket members settled their AVC at retirement**** and below is an average of what they got:

With tax relief and investment growth our clients more than doubled the net amount they invested. With returns like these, an AVC might be the investment you really need!