New Year, New You – it’s time to save for your future!

Every January, millions of people set their New Year resolutions, join the gym, buy a new house or upgrade the car, all of which affect our finances. We’re eager to spend less and put those saving plans in place for our future. But as time goes on, it’s easy to get distracted by life and forget to keep those promises on track! Only 8% of New Year’s resolutions are accomplished!*

An Additional Voluntary Contribution (AVC) makes it easy to save, with just a little going a long way!

So today, we’re going to show you why an AVC is the New Year’s Resolution that should be at the top your list!

What is an AVC?

An AVC is a tax efficient way of saving for your life in retirement.

You get tax relief

The best part about doing an AVC, is that you reduce the amount of tax you pay in your salary!**

For every €100 you contribute to your AVC you can get up to €40 back in tax relief in your salary, if you’re paying income tax at 40%. The real cost to you is only €60!

If you pay tax at 20%, you will reduce your tax by €20 for every €100 you contribute.

Who doesn’t want to pay less tax?

AVCs change to match your life

You can also stop, start, increase and decrease your contributions whenever you like! The vast majority of our members have their AVCs deducted as a percentage of your salary, which means, if there is a time you get paid less you’ll automatically contribute less and vice versa!

Saving in bank accounts is not what it used to be!

Savings accounts, current accounts and deposit accounts just don’t have the same returns as they used to. This is because deposit account interest rates are at an all-time low of 0%.

Make money from your money

Between tax relief and investment growth, AVCs can be a supercharger for your savings!

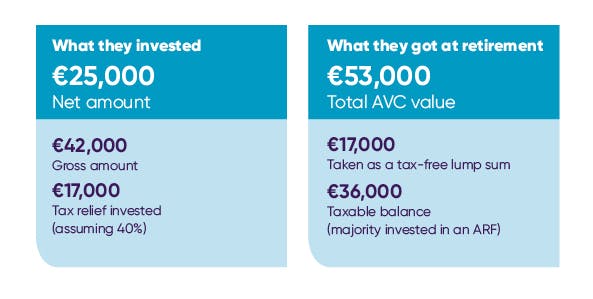

In 2018, over 1500 Cornmarket members settled their AVC at retirement and below are their average values***. The figures speak for themselves!